I'm tired, my brain isn't in the mood, and you guys are smart and shit.

What's with this abolition of the 10p tax rate? Is this the one where you don't pay income tax until you earn about 5.5K, then pay 10% tax after that till about 7.7K, then 22% tax per pound after that till about 35K? So instead, its gonna go, nothing till 5.5K, then 20% beyond that till about 35K?

I hear this 18.5K figure being thrown about saying if you earn less than that, you will pay more tax (which I get if you are now paying 20% tax for the 5.5 to 7.5K band instead of 10%, and then 20% beyond that until 35K)

Is that right? If so, that's fucked! Considering how incredibly easy it is in this country to avoid tax if you are a mega mega earner, taxing the poorest people more is fucking fucked! If so, it means I'll be paying more fucking tax to lighten the load on those earning up to 20K more than I do?!!

Enlighten me if I've got it totally wrong, please?

What's with this abolition of the 10p tax rate? Is this the one where you don't pay income tax until you earn about 5.5K, then pay 10% tax after that till about 7.7K, then 22% tax per pound after that till about 35K? So instead, its gonna go, nothing till 5.5K, then 20% beyond that till about 35K?

I hear this 18.5K figure being thrown about saying if you earn less than that, you will pay more tax (which I get if you are now paying 20% tax for the 5.5 to 7.5K band instead of 10%, and then 20% beyond that until 35K)

Is that right? If so, that's fucked! Considering how incredibly easy it is in this country to avoid tax if you are a mega mega earner, taxing the poorest people more is fucking fucked! If so, it means I'll be paying more fucking tax to lighten the load on those earning up to 20K more than I do?!!

Enlighten me if I've got it totally wrong, please?

The general cuffuffle about it is that it is fucked. Lower-paid people up to about the age of 25 are getting shafted, and they're only just realising by how much.

I'm alright, I don't pay taxes. (mwahahahahahaha)

I'm alright, I don't pay taxes. (mwahahahahahaha)

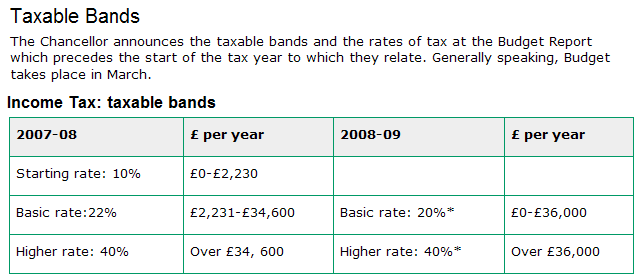

As I understand it, that's income tax for incomes above your allowances noted here.

"The abolition of the 10p rate" means you pay double the tax you used to on the first two grand above your allowance. Above that, you pay a tiny bit less tax than you would.

Basically, low income folks are down about £230 a year, while higher earners aren't affected or are better off.

In theory, low wage earners will be better off *if* they satisfy the eligibility requirements for tax credits and bother to go through the hoops needed in order to claim them. If you're say, single and self-employed, I believe these hoops are kinda tricky.

I'm guessing that Gordon knows many won't bother claiming and has written off their vote in any case.

I'm guessing that Gordon knows many won't bother claiming and has written off their vote in any case.

You've got it right, and yes it is complete and utter bullshit.

It's likely down to Labour trying to appeal to the vast middle classes based on the assumption they'll get the low-income vote anyway but it's likely to just piss a lot of people off in general. Which is, equally, bullshit. Labour are also pretty much single-handedly responsible for ensuring we have the most complicated tax system in the world.

Fuck you Gordon Brown, fuck you.

It's likely down to Labour trying to appeal to the vast middle classes based on the assumption they'll get the low-income vote anyway but it's likely to just piss a lot of people off in general. Which is, equally, bullshit. Labour are also pretty much single-handedly responsible for ensuring we have the most complicated tax system in the world.

Fuck you Gordon Brown, fuck you.

MrD wrote:

Basically, low income folks are down about £230 a year, while higher earners aren't affected or are better off.

For flip's sake. Where's the Red Wedge when you need it?

Super Tax Credits, Yeah!

Do YOU qualify?

http://www.taxcredits.inlandrevenue.gov ... ehold.aspx

No, of course you fucking don't.

Do YOU qualify?

http://www.taxcredits.inlandrevenue.gov ... ehold.aspx

Quote:

Child Tax Credit

Your household is not entitled to Child Tax Credit because of the following reasons:-

- The household must have care of at least one child who is under the age of 20.

or

- Children between 16 and 19 must be in full time education, or on an approved training course or registered with your local careers service or Connexions Service.

or

- Children between 19 and 20 must be in full time education or on an approved training course that began before their 19th birthday and their date of birth must be later than 05/04/1987.

Working Tax Credit

Your household is not entitled to Working Tax Credit because of the following reasons:-

- The claimant(s) must have children and work 16 hours per week or more.

or

- Claimant(s) who do not have children must work 30 hours per week or more and be aged 25 or over and are not disabled.

or

- Claimant(s) who are disabled must work 16 hours per week or more.

or

- Claimant(s) who are aged 50 or over must have been unemployed and in receipt of benefits for 6 months leading up to the claim and work 16 hours per week or more.

This is based on your household income of £12250.00.

To find out more about tax credits click 'What are tax credits?'

If you would like any further help about claiming tax credits please phone the help desk.

To make a claim:

You can order a claim pack by calling the help desk.

Or you can pick up a claim pack from your nearest HMRC Enquiry Centre or Jobcentre Plus Office.

Your household is not entitled to Child Tax Credit because of the following reasons:-

- The household must have care of at least one child who is under the age of 20.

or

- Children between 16 and 19 must be in full time education, or on an approved training course or registered with your local careers service or Connexions Service.

or

- Children between 19 and 20 must be in full time education or on an approved training course that began before their 19th birthday and their date of birth must be later than 05/04/1987.

Working Tax Credit

Your household is not entitled to Working Tax Credit because of the following reasons:-

- The claimant(s) must have children and work 16 hours per week or more.

or

- Claimant(s) who do not have children must work 30 hours per week or more and be aged 25 or over and are not disabled.

or

- Claimant(s) who are disabled must work 16 hours per week or more.

or

- Claimant(s) who are aged 50 or over must have been unemployed and in receipt of benefits for 6 months leading up to the claim and work 16 hours per week or more.

This is based on your household income of £12250.00.

To find out more about tax credits click 'What are tax credits?'

If you would like any further help about claiming tax credits please phone the help desk.

To make a claim:

You can order a claim pack by calling the help desk.

Or you can pick up a claim pack from your nearest HMRC Enquiry Centre or Jobcentre Plus Office.

No, of course you fucking don't.

- Claimant(s) who do not have children must work 30 hours per week or more and be aged 25 or over and are not disabled.

Why? What possible reason is there for this?

Why? What possible reason is there for this?

According to the excellent ListenToTaxMan incomes of at least 16k and 19k are better off under the 2008/9 schema than the 2007/8 one.

according to that I wont lose cash, but in fact be better off than 2007/8

vegetables wrote:

- Claimant(s) who do not have children must work 30 hours per week or more and be aged 25 or over and are not disabled.

Why? What possible reason is there for this?

Why? What possible reason is there for this?

Because below that your parents are still responsible in theory.

Seriously, that's the reasoning.

Right, I thought I understood it correctly. This is shit. I worked my wage out on the taxman site and I pretty much remain exactly the same instead of the 5 quid ish a month increase I would have got at the end of the tax year if it had stayed the same. So no biggie for me then, but this will totally fuck people on much lower wages. What a complete cunts trick this is! Keep money in the pockets of the middle classes so that they keep happy, voting Labour and having more disposable income to keep the (un-sustainable) economy afloat. Single working class folk get fucked all over again! Unbelievable, I thought we voted out the government who used to pull tricks like this 10 years ago!?

No, this lot hate the non-rich too.

Mr Chris wrote:

No, this lot hate the non-rich too.

So it seems.

pupil wrote:

Mr Chris wrote:

No, this lot hate the non-rich too.

No, they really do.

HATE THEM. THEY SMELL. SO VERY VERY POOR. NO MUNNNEEEEE.

Cunts.

I'm dreading the next general elections already

It's just hit me what a large number 40% is. Bloody hell.

Indeed it fucking is.

MrD wrote:

It's just hit me what a large number 40% is. Bloody hell.

Am I right in working out that you pay 40% when you earn over about 41.5K? (36K high band threshold + your non tax earning allowance of about 5.5K) or do you pay after 36K.

Either ways, sucks to be earning and paying tax in London with the wage/living costs trade off!

pupil wrote:

Am I right in working out that you pay 40% when you earn over about 41.5K? (36K high band threshold + your non tax earning allowance of about 5.5K)

This. It kicks in after 36k of taxable income, so the £5435 tax free allowance goes on top, so your gross salary needs to be 41.5k before 40% tax starts to bite. richardgaywood wrote:

pupil wrote:

Am I right in working out that you pay 40% when you earn over about 41.5K? (36K high band threshold + your non tax earning allowance of about 5.5K)

This. It kicks in after 36k of taxable income, so the £5435 tax free allowance goes on top, so your gross salary needs to be 41.5k before 40% tax starts to bite.Ta, got it sussed now.

pupil wrote:

So no biggie for me then, but this will totally fuck people on much lower wages.

I'm not sure I agree; according to ListenToTaxMan, a salary of 10k sees a drop of £8.46 per month. That's full time minimum wage, more or less. Someone on 7.5k per year will lost the most (just under the old 22% bracket) and lose £12.63 a month.These are drops, true, and they are drops to the poorest members of society -- I'm not saying that's good. But I'm not sure these drops are big enough to qualify as "totally fucking" people... what do people think?

Well, Mr Gaywood, the only people losing out on this are the poor. So, yeah. Fucking them, really. I'm doing well out of this change, which is utterly utterly wrong. I'm happy to pay a little bit more tax if it will help the country, not less.

Of course it all, in my wife's experience as a management consultant secondee to the cabinet office and various other government departments, gets pissed up the wall on consultants to keep the permanent headcount down after Gershon, and the PFI nonsense.

Of course it all, in my wife's experience as a management consultant secondee to the cabinet office and various other government departments, gets pissed up the wall on consultants to keep the permanent headcount down after Gershon, and the PFI nonsense.

Mr Chris wrote:

Well, Mr Gaywood, the only people losing out on this are the poor. So, yeah. Fucking them, really. I'm doing well out of this change, which is utterly utterly wrong. I'm happy to pay a little bit more tax if it will help the country, not less.

As someone in that 40% tax bracket I very much agree. I've always supported a strong welfare state with relatively high taxation, i.e. the European model not the US one. What I was getting at is that this drop in income tax may not be as significant as the benefits changes, for example, and if so, is it better to attack those instead? Also I wasn't stating that was my opinion; I was wondering aloud. Oh heavens, not having a go, sir.

I do sometimes whinge about the 40% of the big slice of my pay that fucks off to the Treasury, but I'd far rather we were in the European model than the US, fuck the poor, one. Socialism shouldn't ever EVER be a dirty word.

I do sometimes whinge about the 40% of the big slice of my pay that fucks off to the Treasury, but I'd far rather we were in the European model than the US, fuck the poor, one. Socialism shouldn't ever EVER be a dirty word.

Mr Chris wrote:

No, this lot hate the non-rich too.

The Brownites do, man. You wouldn't believe how much the grassroots local Labour membership is appalled by all this. (I go to regular boring meetings.) Oh, and plenty of Labour MPs from the sounds of it. We've got a really unpopular leader in Brown amongst the former at least... A proper leadership contest against someone viable, and Brown would have been toast. And rightly so, because the man's obviously completely unhinged.Mr Chris wrote:

Socialism shouldn't ever EVER be a dirty word.

Dude, if by socialism you mean social democracy, then fuck yeah, complete agreement here. Well no £12.63 a month isn't much. To most people. But if you're in the 10% tax bracket you're likely struggling to make the rent and eat every month anyways, and that's a week's food on a tight budget.

pupil wrote:

MrD wrote:

It's just hit me what a large number 40% is. Bloody hell.

Am I right in working out that you pay 40% when you earn over about 41.5K? (36K high band threshold + your non tax earning allowance of about 5.5K) or do you pay after 36K.

Either ways, sucks to be earning and paying tax in London with the wage/living costs trade off!

And that's the thing, especially if single and thus lacking 2 sets of allowances and all the other lovely things governments give people because they manage to successfully shag, £41.5k is not a massive wage in London by any means, yet you get taxed on the same basis. I for the record am nowhere near 40% just yet.

Quote:

I'm not sure I agree; according to ListenToTaxMan, a salary of 10k sees a drop of £8.46 per month. That's full time minimum wage, more or less. Someone on 7.5k per year will lost the most (just under the old 22% bracket) and lose £12.63 a month.

These are drops, true, and they are drops to the poorest members of society -- I'm not saying that's good. But I'm not sure these drops are big enough to qualify as "totally fucking" people... what do people think?

These are drops, true, and they are drops to the poorest members of society -- I'm not saying that's good. But I'm not sure these drops are big enough to qualify as "totally fucking" people... what do people think?

What you have to realise is that, if you're earning £800 a month or so, £12.63 is going to be a big, big proportion of your disposable income, assuming you even HAD disposable income.

What I don't understand is why the govt is doing it? You could see the tories doing it, well because they're tories but for a Labour govt to do this is simply shameful, absolutely shameful.

Clearly they are trying to reduce poverty, by taxing it. Works for smoking.

markg wrote:

Clearly they are trying to reduce poverty, by taxing it. Works for smoking.

793 bananas.

markg wrote:

Clearly they are trying to reduce poverty, by taxing it. Works for smoking.

HA.

Thank you, sir.

Anonymous - I meant social democracy, yes, rather than Communism.

Having said that, as was discussed at tedious student lengths on my public law course at university, you can come up with the most morally idealistically wonderful political system in the world, and put in all the checks and balances you like, but as soon as you put people into it, with all of their stupidness and selfishness, it goes to pot. Communism is a great idea in theory, but people are too rubbish to make it work.

Maybe in small groups, like, say the Isle of Man. No... wait..

Gerry Mander wrote:

In theory, low wage earners will be better off *if* they satisfy the eligibility requirements for tax credits and bother to go through the hoops needed in order to claim them. If you're say, single and self-employed, I believe these hoops are kinda tricky.

I'm guessing that Gordon knows many won't bother claiming and has written off their vote in any case.

I'm guessing that Gordon knows many won't bother claiming and has written off their vote in any case.

"Hello. I'm single and self-employed, although I'm looking into volunteering and/or doing a fairly low-wage job at a museum for a totally irregular number of hours per week as an aside. I've moved house six times in just over four years, but now I rent a room in a shared house, although I am not strictly speaking a tenant as my flatmates are technically the only bill-payers and I am merely signed in as their dependent, because that was easier than dicking around with a new contract. Oh, and one of them is pregnant, and was recently made redundant and is now sort of self-employed, but not really. The other works full-time at a low-wage job, but is also sort of self-employed and does a lot of work in his spare time for one of his boss' competitors. I only have enough to eat this month because a client gave me their credit card and PIN instead of a cheque. Taking a fifth of my income could literally destroy any chance all three of us have of starting a business and leave us totally fucking doomed to work shitty fucking shop jobs for fifty fucking years because any time any one of us tries to fucking improve our lot we get fucked up the arse by a bunch of parasitic cockscabs who are as morally bankrupt as we are financially. This 'tax all the poor people and then make them work even more to get their money back' is almost as good as NOT FUCKING TAKING THE MONEY IN THE FIRST PLACE, YOU LYING, DESPICABLE CUNTS.

So anyway, can I have some of the money I earned back now, please? I know you've got funny-looking foreign people to bomb and everything, but I need to eat. Thanks!"

Still, on the plus side, we have the internet again.

Morte wrote:

What I don't understand is why the govt is doing it? You could see the tories doing it, well because they're tories but for a Labour govt to do this is simply shameful, absolutely shameful.

Easy, to get the highlight of a cut from 22-20%.

Morte wrote:

What I don't understand is why the govt is doing it? You could see the tories doing it, well because they're tories but for a Labour govt to do this is simply shameful, absolutely shameful.

Because the Labour and Tory parties are essentially the same thing, except that Labour wear cheaper suits.

sinister agent wrote:

Morte wrote:

What I don't understand is why the govt is doing it? You could see the tories doing it, well because they're tories but for a Labour govt to do this is simply shameful, absolutely shameful.

Because the Labour and Tory parties are essentially the same thing, except that Labour wear cheaper suits.

...True and it's a disgrace that we have got to this situation.

Morte wrote:

sinister agent wrote:

Morte wrote:

What I don't understand is why the govt is doing it? You could see the tories doing it, well because they're tories but for a Labour govt to do this is simply shameful, absolutely shameful.

Because the Labour and Tory parties are essentially the same thing, except that Labour wear cheaper suits.

...True and it's a disgrace that we have got to this situation.

Indeed. Gordon Brown should be able to afford a nice suit!

As a higher tax payer, I am made 297 pounds a year better off by this change. I guess that should make me happy, but it just makes me feel a little guilty.

Oh well, at least it paid for all the video games I bought this week.

Topicality, we has it. Does anyone have any headline-figures analysis of the corresponding benefits changes? I'm wary of political analysis that comes from the heads of opposing parties but for a senior Labour figure to be threatening to quit is clearly quite the mess.

When David Blunkett criticises the government for being too right wing, you know something has gone very, very wrong.

vegetables wrote:

When David Blunkett criticises the government for being too right wing, you know something has gone very, very wrong.

To be fair I don't think he's all that right wing, just wildly authoritarian.

This tax thing is fucked up though, and I say that as someone who will probably benefit from this change.

vegetables wrote:

When David Blunkett criticises the government for being too right wing, you know something has gone very, very wrong.

Aye. I may have to break with the ancient tradition of taking every opportunity to call David Blunkett a twat this time.

Authoritarianism has nothing really to do with being right-wing. It's probably more common in left wing thinking, though it's the other axis on the plot from economic policy.

AceAceBaby wrote:

Authoritarianism has nothing really to do with being right-wing. It's probably more common in left wing thinking, though it's the other axis on the plot from economic policy.

Is it even useful to talk about left-wing/right-wing any more?

When being left-wing meant being pro-equality and fairness and being against iniquity and the self-seeking elements of the established order, it seemed like the natural choice for anyone with a social conscience.

Now it's all confused.

A vote for Labour means a vote for an authoritarian party of the new establishment.

When did that happen?

I understood that the tax-free personal allowance had been raised by £200 a month, thus cancelling out the abolishment of the 10% rate. Is this not the case?

Gerry Mander wrote:

A vote for Labour means a vote for an authoritarian party of the new establishment.

When did that happen?

When did that happen?

This is true, but a vote for Labour is clearly not a left wing vote. At what point that changed I'm not sure, but I began to realise it in about, ooh, 1997 I think.

The problem is that Labour knows most of their core supporters will support them no matter what rather than have the Conservatives in charge, even if Labour's views no longer align with theirs. I hope the Liberal Democrats manage to finally get the influence required to push through proportional representation this election - that would make things /very/ interesting.

Halo wrote:

The problem is that Labour knows most of their core supporters will support them no matter what rather than have the Conservatives in charge, even if Labour's views no longer align with theirs. I hope the Liberal Democrats manage to finally get the influence required to push through proportional representation this election - that would make things /very/ interesting.

Sweet Lord, good Christ YES, I pray that we will see proportional representation as soon as possible, as this seems to be our only hope from things veering drastically even further right.

kalmar wrote:

This is true, but a vote for Labour is clearly not a left wing vote.

Depends on the MP, or councillor, or candidate. You couldn't deny that voting for a Campaign Group member like John McDonnell or Alan Simpson (for example) isn't a left-wing vote.pupil wrote:

Sweet Lord, good Christ YES, I pray that we will see proportional representation as soon as possible, as this seems to be our only hope from things veering drastically even further right.

Looks like we may have a changed voting system sooner than we think; but unfortunately Jack Straw might go with Alternative Vote, which is less proportional than our current system(!).Still, I think the LibDems will be worth their existence if they can force PR somehow. It won't do them any good in the long term I think, but if PR makes viable some other progressive parties, we can't fail. Labour needs a party to the left of it to compete for votes from. Labour's European sister parties tend to be moderate because of that.

PR's biggest problem is that it will require a majority to vote it in, and it never benefits a party with a majority.

If we get it, it'll be a government, with a majority, that knows they're doomed in an imminent general election.

If we get it, it'll be a government, with a majority, that knows they're doomed in an imminent general election.

Page 1 of 2 [ 54 posts ]